That’s because dealers make a commission on car financing, which might be added to the interest rate offered to you.ĭealers may have special promotions with lower financing rates for certain car models. However, you may end up paying a higher interest rate than if you get a loan yourself directly from a bank or credit union. You won’t need to find a bank and the paperwork is handled by your car dealer. The biggest advantage of dealer financing is that it's convenient and fast. Each option has its own set of pros and cons, so it's important to compare all of your options before making a decision.ĭealer financing is often the easiest option, as you can usually get financing right at the dealership. You can even finance a car purchase by using a HELOC, a personal line of credit, or with a cash-out refinance. You can finance through a bank, credit union, or dealer. There are a few different options for financing a car purchase in Canada. This will use the car sales tax rate that applies in that province. Finally, select the province that the car will be purchased in. If you have an outstanding car loan on the car being traded in, you will need to enter the remaining loan balance of that loan.

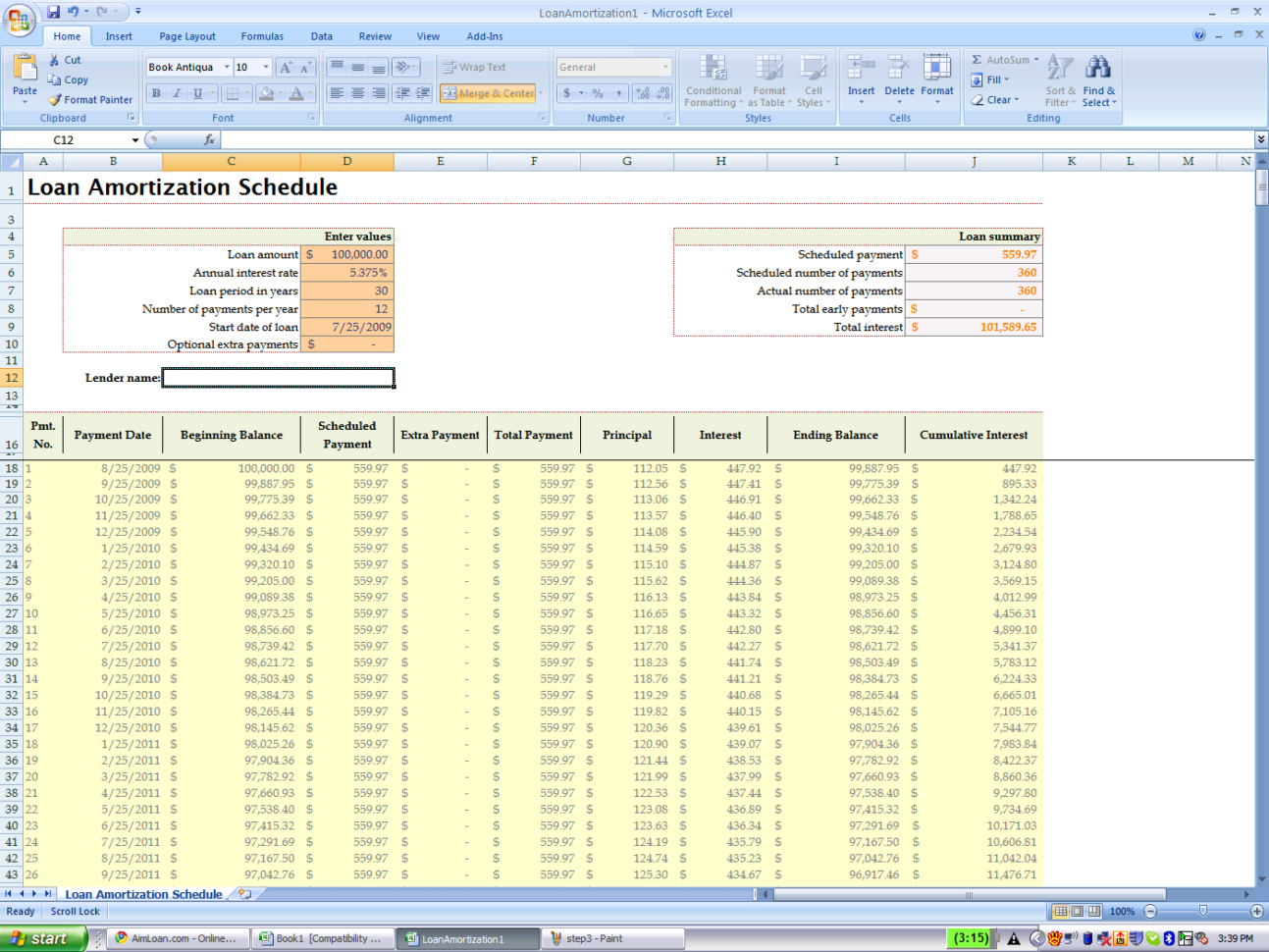

You can optionally include a down payment and trade-in value which will be subtracted from the loan amount. To use this calculator, enter your car purchase price, the loan term in either months or years, and the interest rate. While car loans are used to buy a car, you can use a car title loan to borrow against a car you already own outright. This car loan calculator can be used for a new or used car loan, and it also factors in car sales tax for your province. The car loan calculator will also show how the length of your car loan affects both your monthly car loan payment and the total interest paid. If you're trading in a car, you can enter the estimated trade-in value to lower your monthly payment. This car loan calculator will help you determine what kind of loan you can afford, how much a car loan will cost you, and how making a down payment can reduce your car loan payments. = ( 12 0.06 ) × $30, 000 = 0.Getting financing for a new or used car purchase can be daunting, and negotiating a good car loan interest rate is often challenging. Here's the standard formula to calculate your monthly car loan interest by hand: You can use the car loan calculator to determine how much interest you owe, or you can do it yourself if you're up for a little math. As you pay down the balance over time, the interest portion of the monthly payments gets smaller.

So, in the early days of the loan, when the balance is higher, you pay more interest. The interest you pay each month is based on the loan's then-current balance. With most car loans, part of each payment goes toward the principal (the amount you borrow), and part goes toward interest.

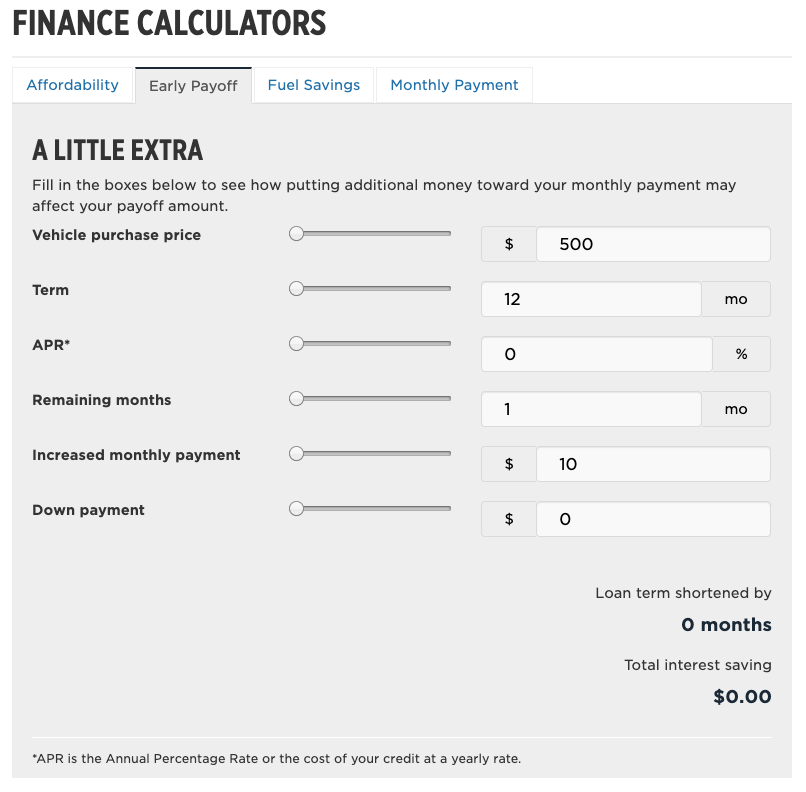

If the calculator offers an amortization schedule, you can see how much interest you'll pay each month. How Is Interest Calculated on a Car Loan?Īn auto loan interest calculator shows the total amount of interest you'll pay over the life of a loan. Use the auto loan calculator before you head to the car lot so you'll be ready to find a car that fits your budget and negotiate the best deal.

0 kommentar(er)

0 kommentar(er)